Modern customers expect seamless and smooth payment experiences. A lengthy checkout process can alienate potential buyers, leading to lost revenue and negative brand perception. To succeed in today's competitive landscape, businesses must prioritize streamlining payment processing to create a favorable customer experience.

Utilizing innovative technologies like mobile payments, contactless options, and seamless checkout solutions can substantially minimize friction during the payment journey. By offering customers a range of convenient and secure payment methods, businesses can enhance customer satisfaction and cultivate loyalty.

Understanding the Nuances of Payment Gateways

Navigating the world of online transactions demands a solid knowledge of payment gateways. These intricate systems act as the bridge between merchants and customers, facilitating secure exchanges of funds. Though seemingly simple at first glance, payment gateways operate with a complex web of regulations.

It's essential for businesses to delve into these nuances to ensure seamless transactions and safeguard themselves from potential scams.

- Grasping various payment gateway categories

- Evaluating the features offered by different providers

- Examining security protocols in place

- Knowing transaction fees

By thoroughly investigating these aspects, businesses can make strategic decisions about the payment gateway that best meets their specific needs.

Optimizing Your Payment Processing System for Growth

As your business expands, it's crucial to ensure your payment processing system can adapt to demand. A robust system minimizes transaction failures and improves customer satisfaction. Consider these strategies:

* Automate repetitive tasks like payment processing to free up resources for core business activities.

* Link your payment processing system with other applications to foster a seamless customer experience.

* Leverage advanced security measures to secure sensitive customer data and reduce the risk of fraud.

* Continuously track your payment processing system's performance to pinpoint areas for enhancement.

Identifying Fraud in in Payment Processing

Effective fraud detection is paramount in the realm of payment processing. With the ever-increasing prevalence of advanced fraud schemes, financial institutions and businesses must implement robust strategies to safeguard their operations. Analytics play a crucial role in identifying anomalous activity and preventing the risk of fraud. By continuously evaluating transaction patterns and user behavior, these technologies can flag potential threats in real time, allowing for swift action.

- Regularly updating security protocols is essential to staying ahead of fraudsters.

- Informing employees about common fraud tactics can help prevent internal vulnerabilities.

- Data sharing between industry stakeholders can foster a more robust security ecosystem.

The Future of Payment Processing: Trends and Innovations

The payment processing landscape is rapidly evolving, driven by technological advancements and shifting consumer expectations. Contactless payments, fueled by mobile wallets and near-field communication (NFC), are gaining momentum as consumers seek faster, more secure transactions. Blockchain technology offers to revolutionize the industry with its decentralized and transparent nature, potentially reducing transaction fees and enhancing security. Artificial intelligence (AI) is also altering payment processing through fraud detection, personalized experiences, and automated customer service. As these trends intersect, the future of payment processing forecasts a seamless, secure, and inclusive experience for all.

- Advancements

- Contactless payments

- Decentralized finance (DeFi)

- Data analytics

Secure and Compliant Payment Processing Solutions

In today's digital landscape, enterprises of all sizes require reliable and authorized payment processing solutions. A comprehensive system is essential for safeguarding sensitive customer data and ensuring smooth transactions. By adopting cutting-edge security measures and adhering to industry regulations, businesses can mitigate the risk of fraud and protect their standing.

- Detailed Encryption: Protecting customer data during transmission is paramount. Look for solutions that utilize industry-standard encryption protocols, such as SSL/TLS.

- PCI DSS: Adherence to PCI DSS standards ensures that sensitive payment information is handled securely and responsibly.

- Transaction Monitoring: Advanced fraud detection systems can flag suspicious activities in real-time, preventing unauthorized transactions.

By prioritizing security and compliance, businesses can establish customer trust and confidence, leading to increased sales and a positive brand perception.

Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Mike Vitar Then & Now!

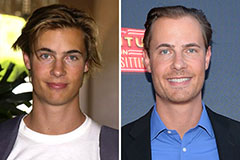

Mike Vitar Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!